The first step to managing a conflict is disclosing it in the first place. Annually each February, faculty, P&A staff, and research investigators must fill out a Report of External Professional Activities, or, REPA, to disclose their significant financial and business interests. If you acquire a new financial or business interest during the year, you can report using a change in circumstances REPA during the year. Finally, if you are involved in research that involves a business entity that you have a financial or business interest in, you can disclose your conflict on a Proposal Routing Form or on an IRB application.

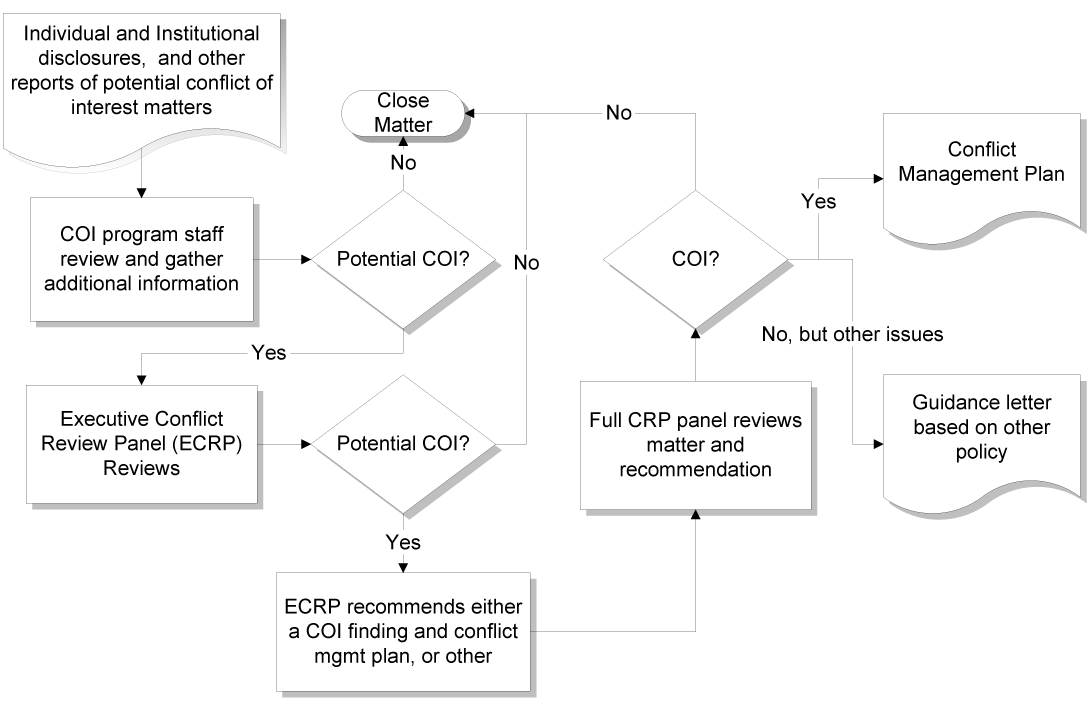

Once a significant financial or business interest is disclosed, the Conflict of Interest Program reviews the disclosure to determine if the SFI or BI is related to the individual’s University responsibilities or expertise. Conflicts of interest could exist where an individual’s SFI or BI overlaps with their research, human participants research, purchasing, or teaching and health care responsibilities at the University. Generally, with timely disclosure of one’s financial and business interests most conflicts of interest can be managed.

We've included a few examples below of where you might see individual conflicts of interest as part of your University responsibilities and how we can manage them. Remember, these are just examples though. When in doubt, always contact the Conflict of Interest Program at 612-626-1462 or repamail@umn.edu. We are here to help you navigate these potentially difficult conflict of interest situations.

Conflict Flow Chart and Examples

Flow Chart

Research

You are the inventor of a new drug licensed to NewCo as part of a University licensing agreement. Under the agreement, you own equity and serve as Chief Scientific Officer of NewCo. You are also continuing to develop the IP as Principal Investigator of an NIH sponsored research project. Your objectivity could be called into question because of your financial and business interest in NewCo.

In this case, you have a significant financial interest in NewCo because you have equity and NewCo's stock is non-publicly traded. You also have a business interest due to your role as Chief Scientific Officer. You should meet with Office for Technology Commercialization representatives early on in the licensing process and then report your financial and business interest on your REPA form. You then can then work with the Conflict of Interest Program and Individual Conflict Review Panel to create a conflict management plan. Since your project is sponsored by a PHS agency (including NIH), the COI Program must timely manage the conflict to avoid a retrospective review.

As part of the conflict management plan, you must disclose your financial and business interests to your research colleagues, on publications and presentations, and to the funding agency. Your Associate Dean for Research meets with you on an annual basis to review the research and ensure that it remains objective.

Human Participants Research

You consult for a large pharmaceutical company. You also wish to serve as an investigator on a human participant clinical trial for a new drug that the company is developing.

In January 2018, a new provision went into effect that prohibits an investigator on a human participant protocol from earning speaking or consulting income from a business entity that is sponsoring a human participant protocol or that owns IP that is being evaluated or developed as part of the protocol. Therefore, if you wish to keep consulting for the company, you would step aside from any role in the research. Alternatively, with approval of the Conflict Review Panel, you may consult for the company if: 1) any payments made in exchange for the services are directed to the University under the terms of a University External Sales Agreement; and 2) the funds are not used to support the salary of the investigator.

Purchasing

Example One: You are a Senior Vice President and a member of a purchasing committee responsible for buying widgets throughout the University. You also own stock in Widgets, Inc., a company bidding for the contract. Your objectivity could be called into question because of your financial interest in Widgets, Inc.

As a University Official, you report this stock holding in Widgets, Inc. on your Financial Disclosure for University Officials (FDUO) form, part of the annual REPA process. The Conflict of Interest Program and Institutional Conflict Review Panel work with you to draft a conflict management plan that requires you to disclose your interest in Widgets, Inc. and to be recused from the committee's deliberative process.

Example Two: Your spouse is the owner of ABC Design Company. You are responsible for the re-design of your department's common area. Your spouse has 20 years experience in the area, so you want to hire ABC to draw up blueprints for the area. Your objectivity could be called into question because of your relationship to your spouse's company.

In this case, you would need to step aside from any aspect of the decision making process on the use of your spouse's firm. Remember that as public employees, Minnesota State Statutes and Nepotism policies apply. Our own financial interests are expanded to include "personal beneficial interests," so we can't make purchasing decisions that benefit our family and friends either. In this case, somebody superior to you must assess ABC's proposal to determine if it meets the needs of the department at the best price. Your superior should seek competitive bids to avoid the appearance of a conflict of interest.

Teaching and Health Care

You consult for Thompson Medical Devices on a new medical device they are developing. You also teach residents about Thompson devices and prescribe them as part of your clinical health care responsibilities. Because you earns income from Thompson, you may have the appearance of favoring their devices over other companies' devices.

You report the consulting relationship with Thompson on your REPA because you earned more than $5000 from Thompson. You meet with the Conflict Review Panel and accept a conflict management plan that requires disclosure to students when teaching about Thompson products and disclosure to patients when using them in clinical healthcare.